By Tony Boyd / Source Financial Review

One way of explaining the amazing surge in commodity prices in the wake of Donald Trump becoming US President-Elect is that there is going to be an infrastructure investment surge on both sides of the Pacific.

The idea is that Trump's commitment to rebuilding America's infrastructure will coincide with an increase in China's policy of investing in infrastructure from China to the Middle East.

Ironically, this confluence of commodity-friendly investment, which would benefit Australia's terms of trade, would be triggered by Trump's isolationist and protectionist trade policies.

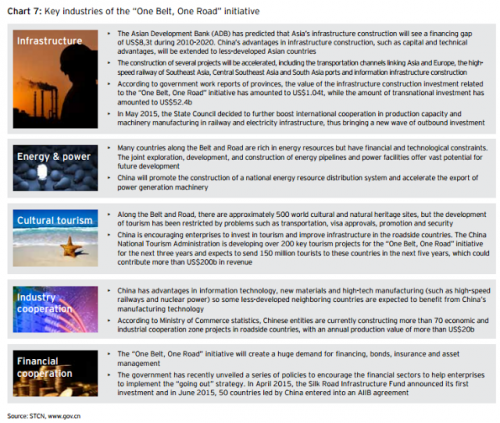

"A more domestically-focused US will probably make more room for China to expand its geopolitical and economic interests through initiatives like "One-Belt-One-Road", according to Steven Sun, head of China Equity Strategy at HSBC.

One-Belt-One-Road is a regional infrastructure investment plan involving the investment of billions of dollars in infrastructure in 60 countries.

Other economists agree that a logical Chinese response to the imposition of tariffs on Chinese exports to the US would be to turn inward and step up its stimulatory domestic policies.

"The trade tensions will also put more pressure on domestic macro policy, introducing an easing bias on the fiscal policy," according to economist Haibin Zhu at JPMorgan in Hong Kong.

Commodity prices were on a roll before the Trump wildcard was thrown down this week. That surge in the price of base metals as well as iron ore and coal was attributed to China's fiscal stimulus over the past nine months and its decision to wind back the production of coal.

Following Trump's election, key commodities took off. Copper, which is a bellwether of global industrial production, rose 3.4 per cent on the London Metals Exchange, taking its gains over the past two weeks to 17 per cent.

A participant at the recent LME Week event in London said the bullish mood towards copper was far greater than in previous years. The metal is now trading at a 15-month high despite evidence this week that Chinese imports in October were the lowest since February 2015.

Coking coal prices rose 4 per cent on Wednesday night to a five-year high of $US295 a tonne.

The other commodity sprinting ahead this week is iron ore. It rose 3.9 per cent after Trump's election victory and has now gained 21 per cent in two weeks.

That helps explain the significant increase in the share prices of irone ore stocks, including Rio Tinto, BHP Billiton and Fortescue Metals Group.

There is a common theme evident with these stocks. When analysts plug in the spot prices for iron ore into their models for these companies there is a material upside risk to their earnings forecasts.

Investors have been reluctant to rely on the high spot prices because of caution about what might happen in China. But the optimists have pointed out that China's President, Xi Jinping, has many incentives to continue his stimulatory policies to maintain growth in the Chinese economy ahead of his reappointment by the Chinese Communist Party early next year.

Xi has as much incentive as every Western leader to ensure that the social harmony, which has been a feature of the country's extraordinary growth over the past decade, is maintained. He does not want a populist, extremist upheaval upsetting his plans to appoint a range of chosen colleagues to important party positions next year.

Trump's election holds out the prospect of the world's largest economy competing with China for the mantle as global infrastructure investment leader.

It is telling that the equity futures markets in the US were down substantially when Trump rose to give his victory speech. The sentiment changed and the futures prices reversed dramatically from negative to positive as soon as Trump mentioned infrastructure.

As with most things that Trump has said, his victory speech was light on detail. But the message was clear that America is going to need a lot of concrete and steel.

"We are going to fix our inner cities, and rebuild our highways, bridges, tunnels, airports, schools, hospitals," Trump said. "We are going to rebuild our infrastructure, which will become ... second to none and we will put millions of our people to work as we rebuild it."

One of Trump's campaign pledges was to work with lawmakers to introduce legislation to "spur $1 trillion in infrastructure investment" over the course of a decade, according to FTI Consulting.

Trump claims the infrastructure bill would be "revenue neutral" and leverage "public-private partnerships, and private investments through tax incentives"

This law is meant to go through in his first 100 days.

By Tony Boyd / Source Financial Review