By Christine Chou, The China Post

Yulin, China -- Many municipalities in China are facing the double struggle of curbing coal output and filling the economic void left by closed mines.

But a coal-rich city in the country's northwest is diversifying in attempt to revive its economy — turning to tourism, agriculture and alternative energy.

Located on the northern tip of Shaanxi province, Yulin has become a poster child for the country's attempts to move away from an economic reliance on mineral resources.

The city has been lauded by the national media as a consummate example of economic transformation.

Deputy Mayor Zhang Haifeng said Yulin was aiming to become "one of the most important cities along the Silk Road."

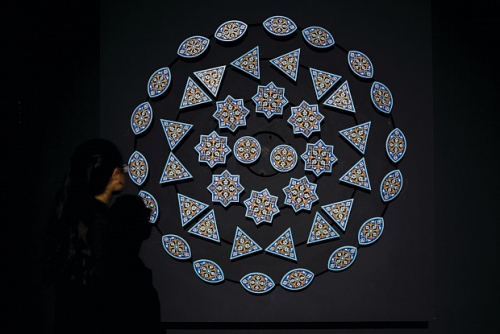

Zhang was referring to the ancient Silk Road trade route, consisting of a string of cities across Central Asia, West Asia, the Middle East and Europe. The route is enjoying a contemporary revival with backing from China's central government.

The new "Silk Road Economic Belt," along with the "Maritime Silk Road" sea route, forms the "One Belt, One Road" initiative started by the China's central government in 2013.

The ambitious plan seeks to adapt the links of the historical Silk Road, and solve the country's domestic overcapacity by improving trade connections with Eurasia.

The history of Yulin comes to the fore when one takes a walk down the streets in the city's downtown, where local snack vendors dot alleys crammed with centuries-old buildings.

A traditional bakery sells hard, dry bread that requires incredible effort to bite into. Our local guide said this durable food had been popular with merchants passing through the city had, as it could last for weeks during the long, dusty journey ahead.

Chinese Kuwait

The discovery of large-scale mineral deposits in the 1980s dramatically changed the face of Yulin.

Zhang said Yulin was known as the "Kuwait of China" given its abundance of gas and coal fields.

The deputy mayor said the city had been "a key area in Shaanxi since ancient times because of its strategic position."

He added that Yulin continued to be an "important city in the nation's 'One Belt, One Road' initiative."

During the city's 11th International Coal and Energy Expo in September, a record-breaking 101 domestic and overseas deals were made with a combined value of 119.7 billion yuan — the highest in history, according to the government.

Local officials seem confident the city will cash in on its cultural capital. With help from the new opportunities provided by central government initiatives, they hope to expand the city into an international hub for the energy and chemical industries.

Turning to Tourism

Yulin's municipal government highlighted tourism and the cultural industries as key development areas.

"We will speed up progress in building up key tourist attractions, improve services offered to foreign visitors and create a unique tourism brand for Yulin," said Zhang.

Head of the tourism bureau Cui Yuan expressed confidence that Yulin's cultural heritage would attract tourists.

As part of these tourism efforts, Yulin was planning to renovate and upgrade its airport and offer flights to more destinations, Cui said.