by Bruce Pannier / Source Radio Free Europe

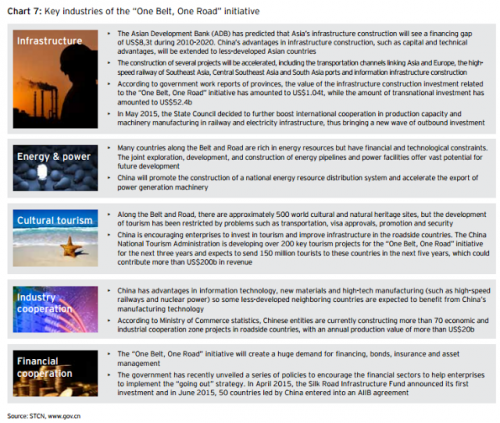

China’s massive One Belt, One Road (OBOR) project aims to connect the world like never before, using land and sea routes to form trade links across Asia and Europe and down to Africa. It’s an extremely ambitious project that will take many years to realize but already OBOR has many people excited about the economic possibilities to come.

Among the billions of people who could benefit immensely from OBOR are the roughly 65 million residents of Central Asia. But being part of OBOR is not necessarily a guarantee for a better future.

To look at OBOR in Central Asia, and some of the potential advantages and disadvantages, RFE/RL assembled a Majlis, or panel, to review the situation.

Moderating the discussion was RFE/RL Media Relations Manager Muhammad Tahir. From Exeter University in the U.K., senior lecturer and Central Asian expert David Lewis joined the discussion. From Geneva, journalist, researcher, and native of Kyrgyzstan Cholpon Orozobekova, who has written for the Jamestown Foundation and The Diplomat took part. I was just back from Washington, New York, and the CESS conference at Princeton and was raring to go, so I pitched in a few comments also.

As Lewis mentioned at the start of the Majlis, the numbers for OBOR are genuinely unprecedented -- $1 trillion of investment with routes potentially reaching some 44 countries with more than half the population of the planet. And, as Lewis pointed out, “This being the initiative of [Chinese President] Xi Jinping, it’s something that the Chinese leadership is committed to and it does involve significant funding for Central Asia in particular, and of course, governments, at least in Central Asia, are very enthusiastic about funding flowing into major infrastructure projects.”

OBOR has already started in Central Asia. Lewis recalled the oil pipeline from Kazakhstan, the natural gas pipelines from Turkmenistan, and a road network from Kyrgyzstan and Tajikistan already lead to China.

These projects and others were started, and some completed, before the autumn of 2013 when Beijing first articulated the OBOR project. As Orozobekova reminded, “In 2013, trade between China and the five Central Asian states was $50 billion already, while, for example, trade between Russia and these [Central Asian] countries was only $30 billion.”

That trend has only become stronger as Russia’s economy has weakened, limiting Russian investment potential. China, meanwhile, has continued to vigorously pursue OBOR. In February this year, the first cargo train from China arrived in Iran after passing through Kazakhstan and Turkmenistan along new railways in the latter two countries. In September, the first train from China to Afghanistan arrived after crossing through Kazakhstan and Uzbekistan.

According to the plan, the part of the route that runs through Central Asia should continue west through northern Iran into Turkey. Central Asia could benefit greatly from this new route for shipping goods to, and receiving goods from countries with access to the Persian Gulf and the Mediterranean Sea.

But already parts of Central Asia are seeing some of the negative aspects that come with these Chinese-funded projects.

“In Central Asia there are some concerns regarding the flow of migrants from China,” Lewis said. He explained: “Typically Chinese companies like to use their own people, bring in Chinese labor to get a job done. It’s often very effective but it doesn’t always give people local jobs and employ local specialists.”

That has led to problems in the oil fields of western Kazakhstan where Chinese employees work, in mining areas in Kyrgyzstan where Chinese employees work, and along various parts of the roads being constructed in Kyrgyzstan and Tajikistan where locals work alongside Chinese workers. Sometimes the problems are caused by rumors of the Chinese receiving better wages, sometimes the lack of the locals’ ability to communicate with the Chinese workers has led to fights.

Chinese farmers are also tending agricultural land in Tajikistan vacated by local farmers who left to find work in Russia. A proposal to lease farmland in Kazakhstan earlier this year sparked the largest protests seen there in some 20 years, when rumors spread that Chinese farmers would lease portions of Kazakhstan’s farmland.

Orozobekova said, “In Central Asia there are some concerns regarding the flow of migrants from China.”

Additionally, while Chinese workers are coming to Central Asia, Lewis said, “China just doesn’t offer that kind of labor migration, there’s no real option to go to China to work.” So Central Asia’s migrant laborers continue to mainly go to Russia.

And there are also environmental concerns. Chinese companies do not have a good track record when it comes to ecological considerations. Lewis explained, “In Kyrgyzstan and in Tajikistan recently, new cement plants developed by China are notoriously polluting industries and can have a really negative effect on local people.” Refineries in Kyrgyzstan and Tajikistan built or operated by Chinese companies have also received complaints from local administrations and residents.

Orozobekova also pointed out for Kyrgyzstan, OBOR is a competitor project. She said many in Kyrgyzstan “are overwhelmed with the EEU, the Eurasian Economic Union.” The EEU is the Russian-led organization that also includes Armenia, Belarus, Kazakhstan, and Kyrgyzstan. Kyrgyzstan officially joined in August 2015. Orozobekova said, “When it comes to OBOR and the EEU there’s a little bit of a clash between them because currently, Kyrgyzstan and Kazakhstan joined the EEU with Russia [and] there are so many problems within this organization [EEU].”

And Orozobekova reminded that since 1998, Kyrgyzstan is also a member of the World Trade Organization, so officials in Bishkek must do some furious juggling to try to simultaneously meet the regulations of all these organizations.

And Lewis noted, “We know there’s a slowdown going on in the Chinese economy and so these very ambitious plans, which require a lot of funding, may be more difficult than was considered.”

OBOR is a thick topic, and one the Majlis will address again in the near future. Participants in this latest Majlis session explored more deeply the benefits and detriments of being one of the first sections of OBOR, including potential security problems, now and in the future.

An audio recording of the discussion can be heard at: